If you are operating in Belgium, France, or Quebec, you may be required to use a fiscal data module (FDM) to track transactions and data for government reporting purposes. After obtaining the required fiscal hardware for your region, configure your fiscal settings in Restaurant Manager.

Configuring FDM Settings

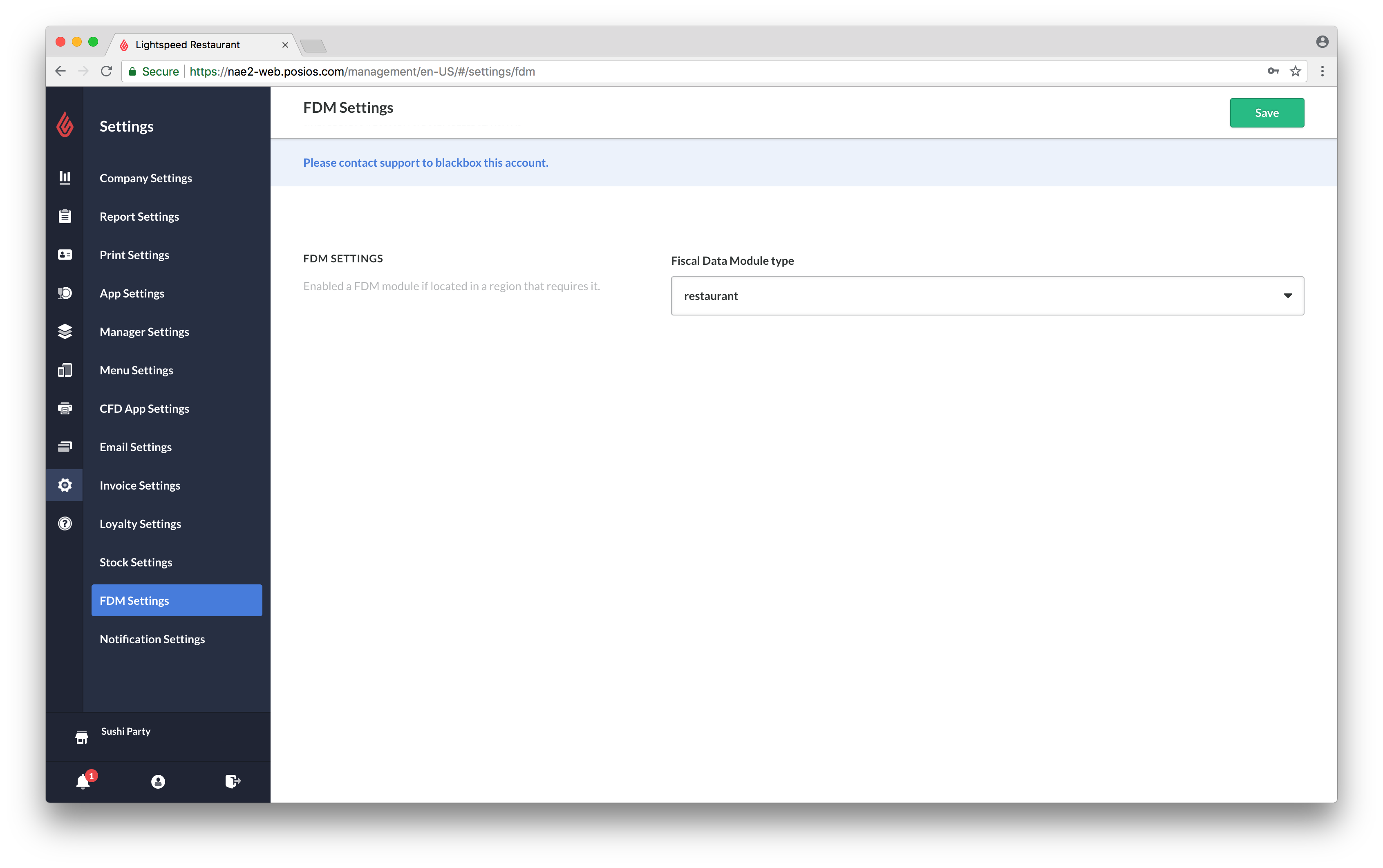

- Navigate to Restaurant Manager > Settings > FDM Settings from the lefthand menu.

- On the FDM Settings page, specify the settings in relation to your local requirements.

- Select Save.

When configuring FDM Settings, always verify your fiscal account info before saving. Your FDM settings can't be changed after they have been saved to Restaurant Manager.

Fiscal data modules per region

| FDM SETTINGS |

Heads up! You'll need to enable a fiscal data module if you're located one of the following fiscal-regulated regions:

|

Blackbox in Belgium

If you are operating in Belgium, you must select the Blackbox restaurant fiscal setting and confirm your VSC pin and BPOS number. You will receive a VSC (VAT signing card) pin number when registering your business with the Belgian sales recording system. A BPOS number - a unique fiscal data module identifier - can be supplied by Lightspeed's Billing team or viewable on the Belgian fiscal site. For more information on registering your business, view the Belgian fiscal registration site.

After saving these settings on Restaurant Manager, you will need to install a sales tracking module (SRM) called Blackbox. For more information on Blackbox hardware requirements in Belgium, see About supported hardware.

Fiscal tracking in the Netherlands

If you are operating in the Netherlands, you can enable FDM Settings if you wish to track sales data. No specific hardware is required and this is an optional, non-mandatory setting. For this option, select the NL fiscal cash register type from the FDM options.

MEV/SRM in Quebec

If you are operating in Quebec, you must select the Quebec-srm type from the FDM Settings list. Once these settings are saved on Restaurant Manager, you will need to install a sales recording module (SRM) and submit monthly sales information to Revenu Quebec.

To install and activate an SRM, you must hire the services of an SRM installer authorized by Revenu Québec. Lightspeed is not authorized to provide installation information for a sales recording module. For more information on MEV/SRM in Quebec, visit the Revenu Quebec site or view the SRM User Guide.

Installing and activating an SRM also requires connecting an MEV-compatible receipt printer. For more information on MEV/SRM hardware requirements in Quebec, see About supported hardware.

French Fiscal in France

If you are operating in France, select the French Fiscal type from the FDM Settings list. Then, from the Company Settings page (navigate to Manager > Settings > Company Settings), submit your tax registration information. From the Tax Registration Number section, submit your VAT number, Siret, and NAF Code for your business.

French fiscal certification

NOTE: As of February 3rd, 2021 it's important for French establishments to print and sign a certificate of fiscal compliance. Signing this form confirms that your business is compliant with French fiscal regulations. All you need to do is:

-

- Print the attestation form (PDF) at the bottom of this page.

- Fill in the required fields.

- Sign the certification.

- Keep the signed certification at all times within your establishment.