Lightspeed Accounting supports the following posting methods for your Lightspeed Restaurant data entries in Xero:

- Journal Entry

- Summary invoice

- Itemized Sales Receipt

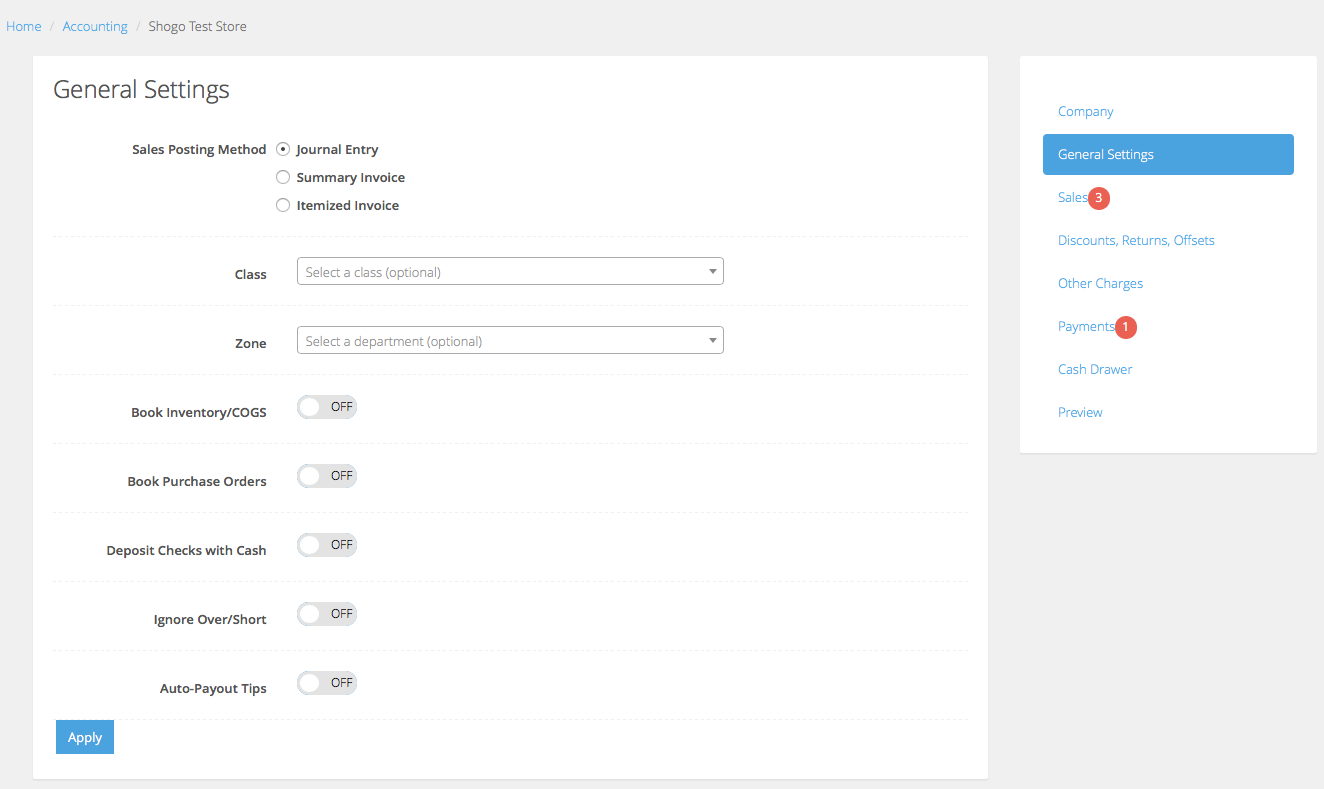

Journal entry

Creates a single journal entry with the sales grouped based on the point of sale department or category, as per Lightspeed Restaurant’s naming convention. With the Journal Entry method, you will see a payment was made but you will have to indicate when the deposit was made for the amount.

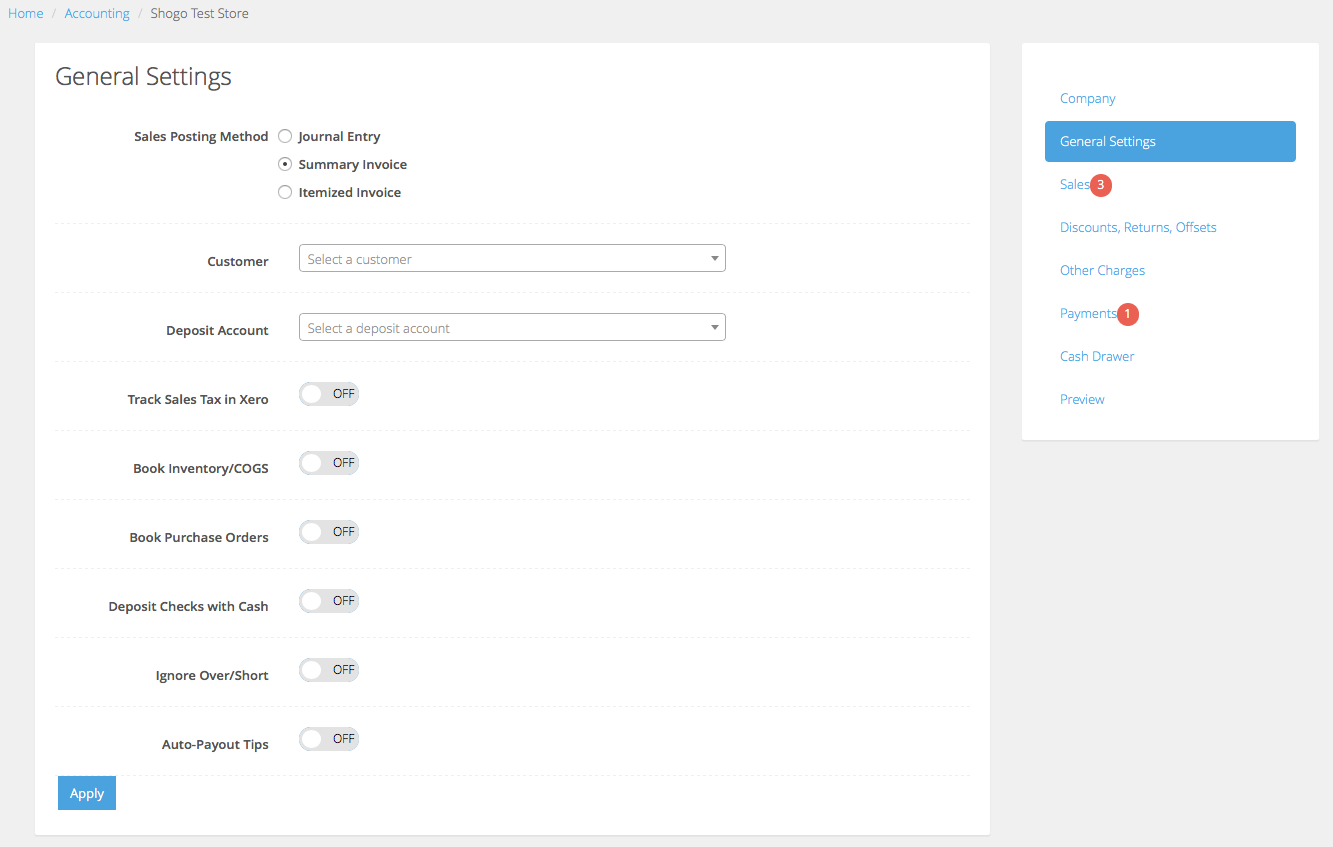

Summary customer invoice

Creates a single Customer Invoice (net-to-cash) based on the point of sale department or category, as per Lightspeed Restaurant’s naming convention. Like the Journal Entry method, you will need to indicate when the deposit was made.

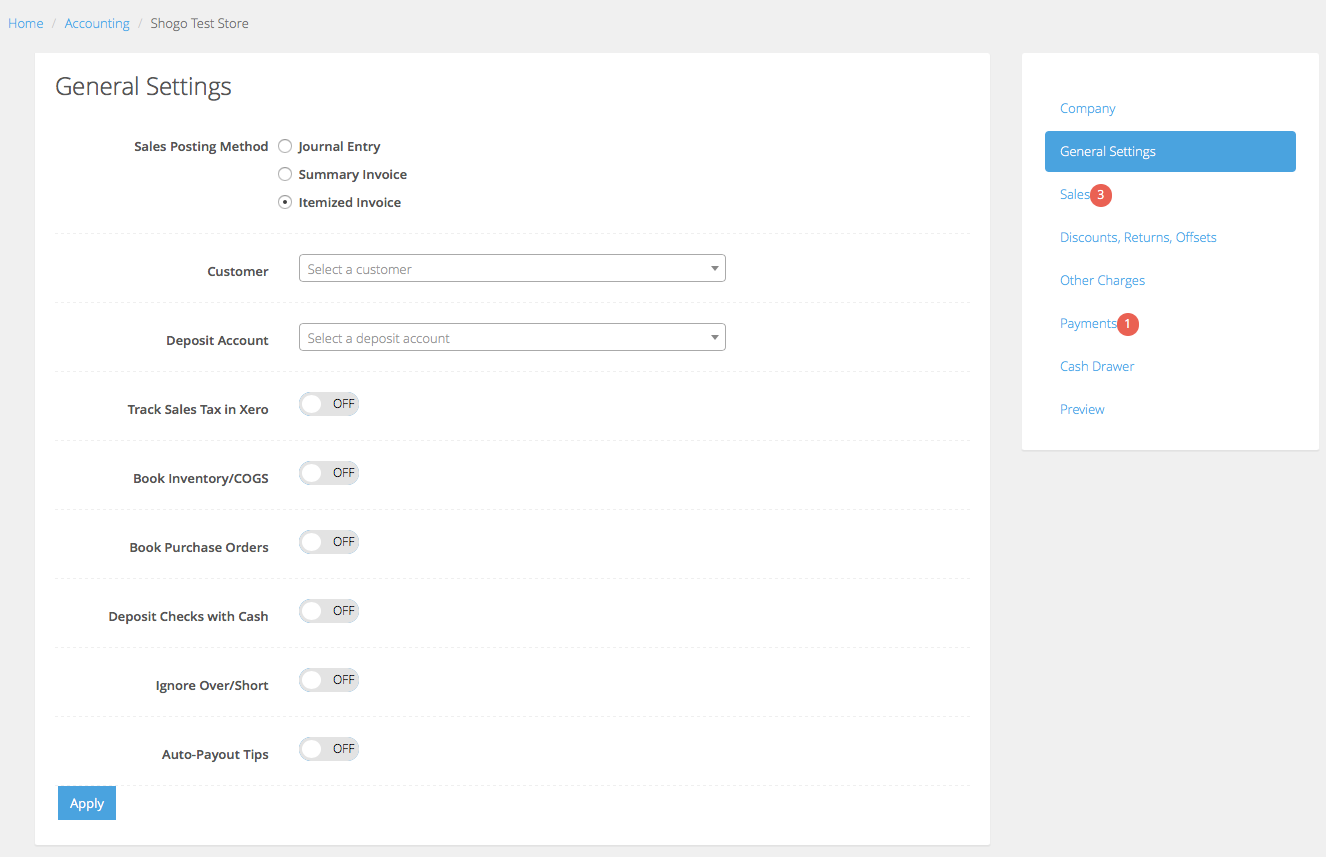

Itemized customer invoice

Creates a single Sales Receipt (net-to-cash) based on the Lightspeed Restaurant item (SKU/PLU). Itemized Invoice will directly deposit the amount into the bank account section of Xero. For exact accounting, this is not the best method.

The following setting options will vary depending on the method selected.

| Customer | Only applies to Sales Receipts. Optionally allows you to associate the Lightspeed Accounting posting with a Xero Contact.

NOTE: Lightspeed Accounting integration is not based on each point of sale transaction, so this contact should be something like Walk-In or Point of Sale not an individual customer who purchased a product/service. |

| Deposit Account |

Only applies to Sales Receipts. Unlike a Xero Summary Invoice, it will create a net balance which will represent the amount of the cash deposit. This will then be recorded into this Deposit Account. Typical types of Deposit Accounts:

|

| Track Sales Tax in Xero | If this is enabled, Lightspeed Accounting use the sales tax rates as defined in Xero, allowing you to match the POS tax rates with Xero. If applicable, you can also specify a non-taxable rate. |

| Book Inventory/COGS |

Creates a journal entry representing Inventory and Cost of Goods Sold offset value amounts based on products sold net of returns. Inventory and COGS accounts are specified at the category level. Please note that this option is a value based integration, not a quantity based (e.g. Lightspeed Accounting will post the cost of how much was sold and not how many). If you are applying your vendor invoices directly to a COGS account in Xero as you are paying your bills, you do not want to enable this option as it will result in duplicate COGS amounts as well as reduce an Inventory Asset account balance that does not exist. |

| Book Purchase Orders | Currently only available for Lightspeed Retail. When a PO is marked as Completed in Lightspeed, this option will create a Purchase Order in Xero. The PO Vendor is auto-created if it doesn’t already exist in Xero. The PO is itemized, using inventory accounts specified in the Inventory/COGS settings. |

| Deposit Checks with Cash | If you deposits checks together with your cash in the same deposit, as recorded on your bank statement, this option will group all cash and check tenders processed on a given date in Lightspeed into one amount. This will facilitate matching with the actual bank deposit. |

| Ignore Over/Short | Depending on your store operations, you can select this to ignore any over/short reported by Lightspeed and instead book the expected cash amount. This is most often used when the merchant knows that the cashiers will frequently not close the drawer properly. |

| Auto-Payout Tips | For Lightspeed Restaurant only. |

______________

Once you have set all of your accounting options, press the Apply button to save your settings.

What's next?

Continue with the configuration by mapping your accounting.