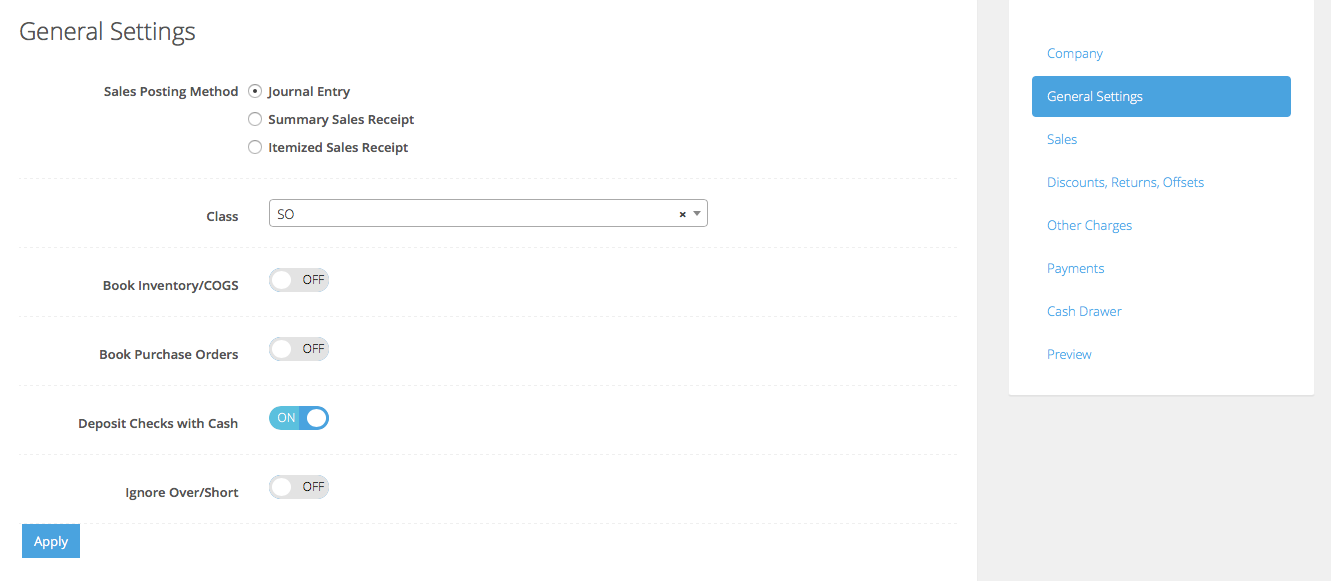

Lightspeed Accounting supports the following posting methods for your point of sale data entries in QuickBooks Sales:

- Journal Entry

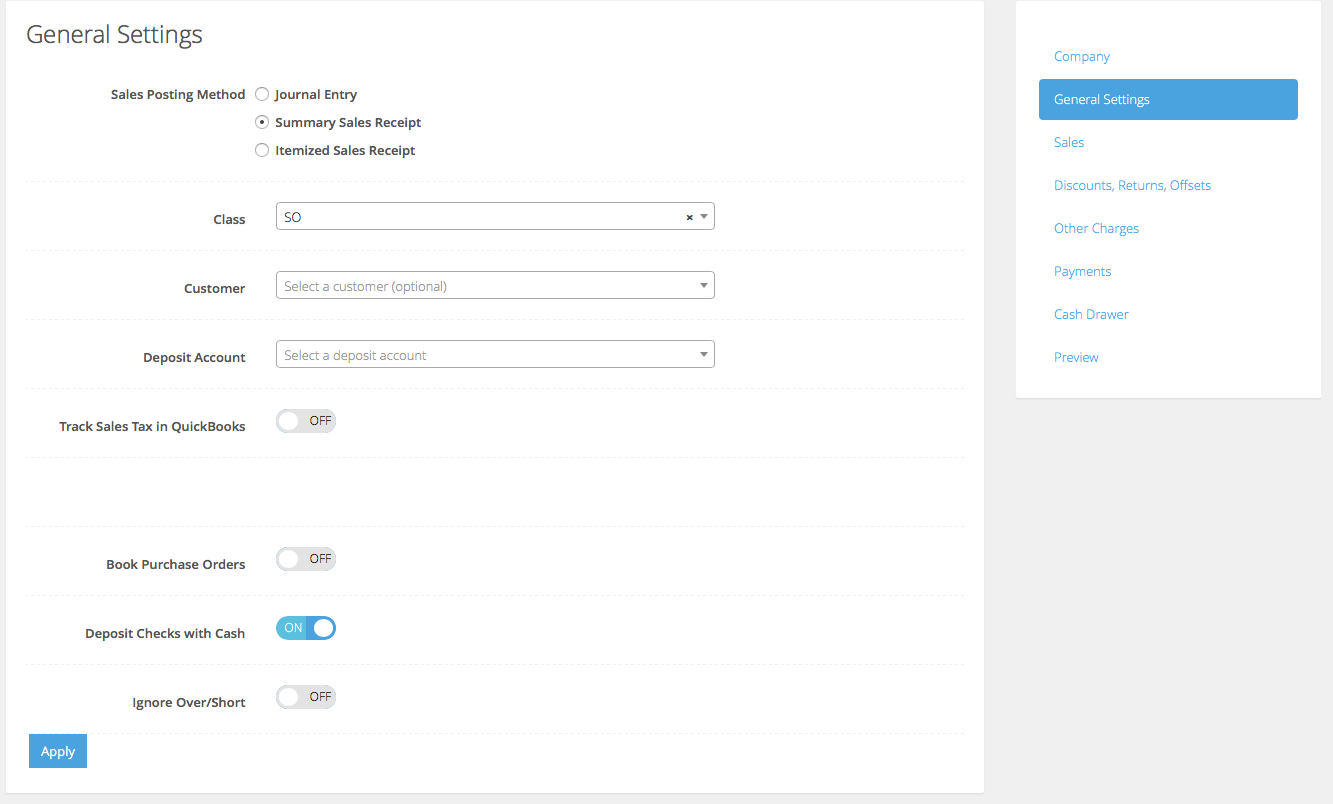

- Summary Sales Receipt

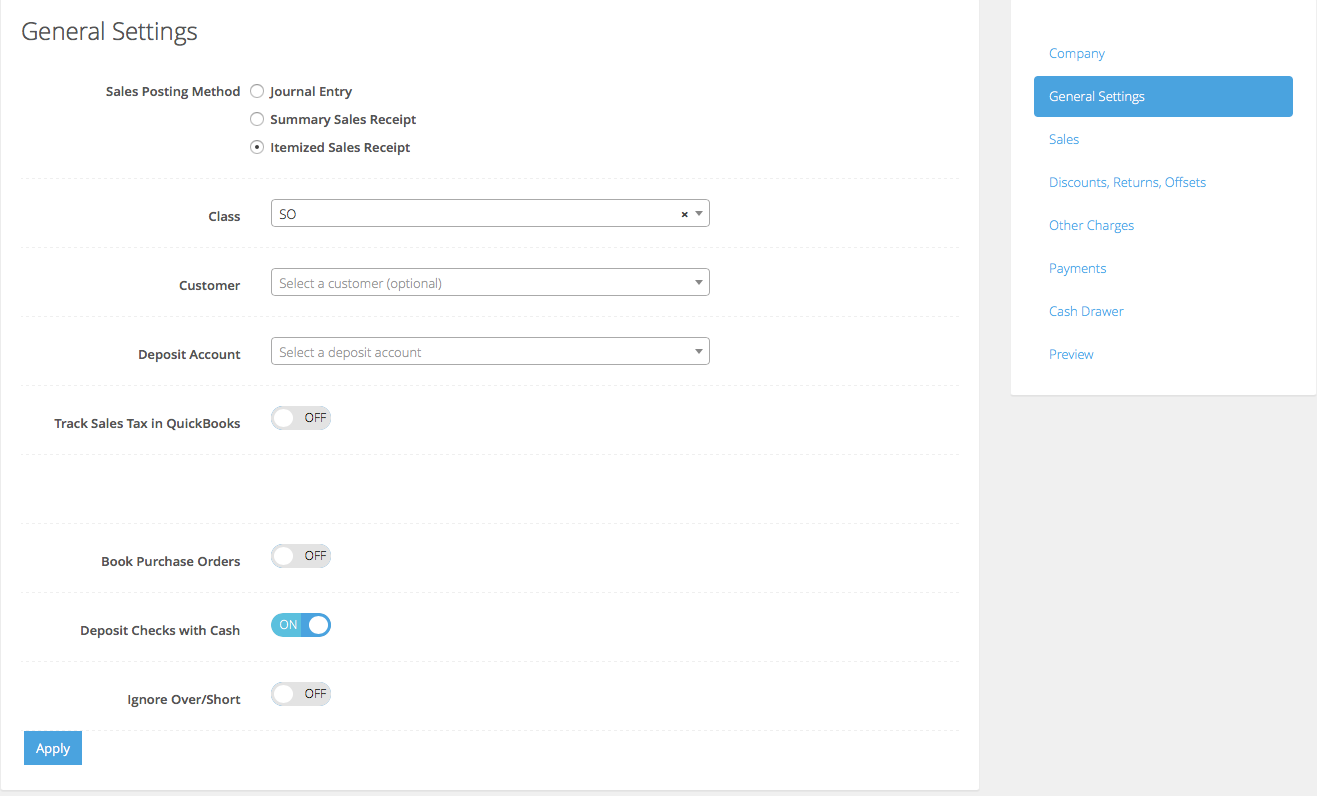

- Itemized Sales Receipt

Journal Entry

Creates a single journal entry with the sales grouped based on the point of sale department or category, as per Lightspeed’s naming convention.

Summary Sales Receipt

Creates a sales receipt (net-to-cash) with sales grouped by category.

Itemized sales receipt

Creates a single Sales Receipt (net-to-cash) based on the Lightspeed item (SKU/PLU).

The individual options are as follows and will vary.

| Customer | Only applies for Sales Receipts and optionally allows you to associate the Lightspeed Accounting posting with a QuickBooks Customer.

NOTE: Lightspeed Accounting integration is not based on each point of sale transaction, so this customer can be something like Walk-In or Point of Sale, not an individual customer who purchased a product or service. |

| Deposit Account | Only applies to Sales Receipts. Unlike a QuickBooks Invoice, Sales Receipts will create a net balance which will represent the amount of the cash deposit, which will be recorded into this Deposit Account. This will, typically, be a Cash on Hand account, the Undeposited Funds account, or (not recommended) an actual bank account. |

| Track Sales Tax in QuickBooks | If this is checked, Lightspeed Accounting use the sales tax rates as defined in QuickBooks, allowing you to match the point of sale tax rates with QuickBooks. You can also optionally specify a non-taxable rate, if applicable. |

| Book Purchase Orders | Currently not available for Lightspeed Restaurant. |

| Deposit Checks with Cash | If you deposit checks together with your cash in the same deposit, as recorded on your bank statement, this option will group all cash and check tenders processed on a given date on the point of sale into one amount to facilitate matching with the actual bank deposit. |

| Ignore Over/Short | Depending on your operations, you can select to ignore any over/short reported by your point of sale and instead book the expected cash amount. This is most often used when the merchant knows that the cashiers will frequently not close the drawer properly. |

Once you have set all of your accounting options, press the Apply button to save your settings.

What's next?

Continue with the configuration by mapping your accounting.